Digital Payments Exploding in India, Yet the Tech-Savvy Teens Still Stuck Paying with Cash

Summary of survey findings:

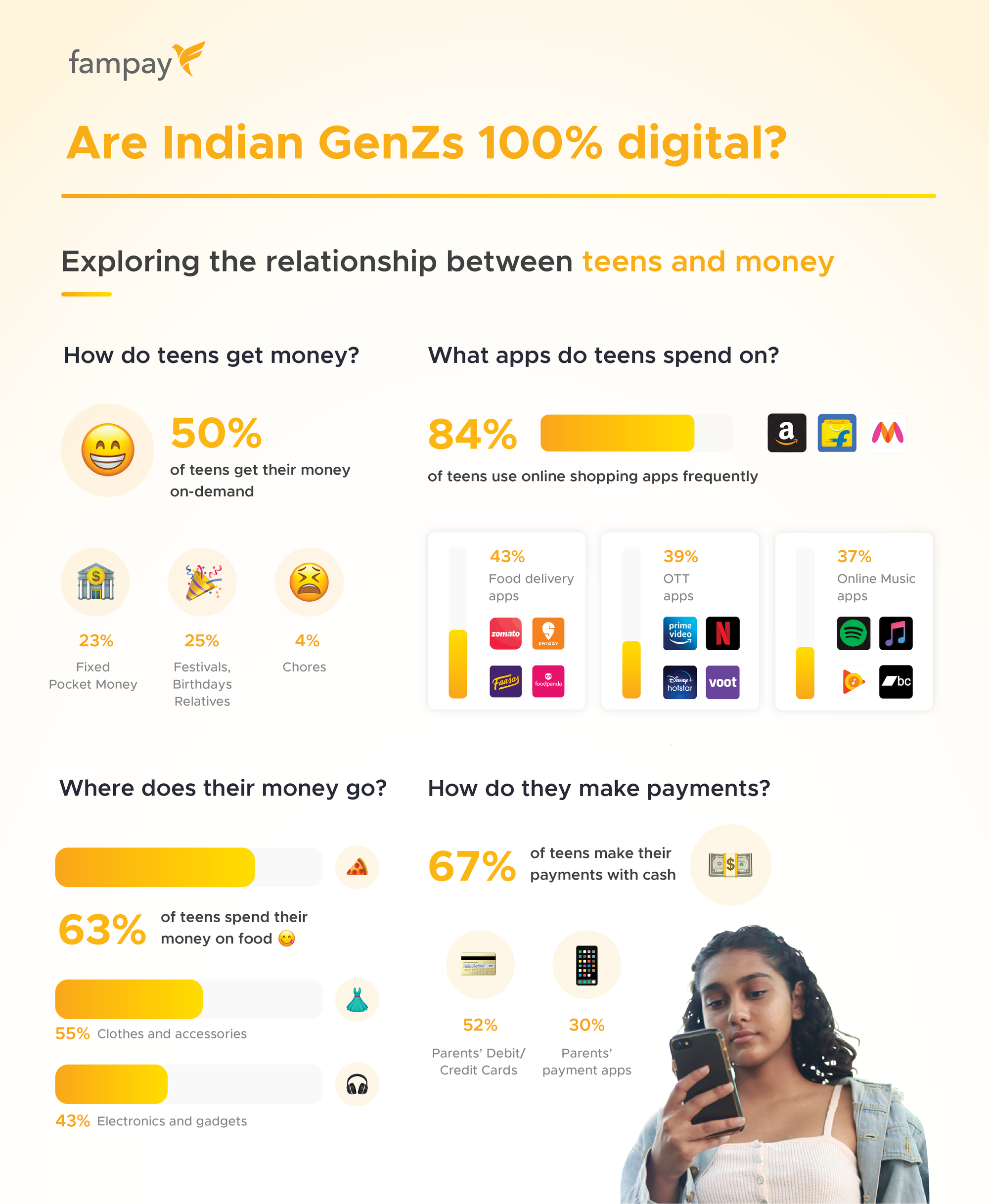

- 84 percent of Indian teenagers love to shop online but a majority 67 percent are stuck paying in cash

- Top 3 spends are on food, clothes and accessories; girls make higher spends on clothes, boys on food & gadgets

- Teens like their brands! Apple, Nike & Netflix are the most preferred brands in their respective categories

- Teens get money on demand from parents than from fixed pocket money

- Instagram is the most popular social media app

- Today’s teens are socially aware & a majority are vocal about ‘Made in India’

Bengaluru, India, October 8, 2020 - India’s teenagers who are digital natives, love online shopping, a trend that has only accelerated during the last six months owing to the pandemic, reveals a survey by FamPay, India’s first Neo Bank for teenagers. Ironically, digital savvy teens are stuck paying with cash as they are not a part of the online financial ecosystem. FamPay is the first in India to bring cashless convenience to millions of teens and their parents with its numberless card and App. FamPay conducted this survey with 1200 teenagers (GenZ) to understand their payment and spending habits, lifestyle choices and aspirations.

“Digital payments have become the ‘new normal’ for 300M adults, but not for 250M teenagers, making them totally dependent on cash or their parents’ cards for the last mile of completing a transaction. Today’s teens are tech savvy and it’s only logical that they be involved users in the digital payment ecosystem. We are extremely keen on taking a customer-first approach in everything that we do. This survey was focused to understand our consumers deeply and build a product that begins and defines their journey to be financially independent.”, said Sambhav Jain, Co-Founder, FamPay.

The survey reveals that 84 percent of Indian teens love to shop online, a trend that has accelerated since the lockdown. Despite the Digital India trend, 67 percent of teens continue to pay in cash and 52 percent of teens pay through their parent’s debit/credit card, thereby continuing to be outside the digital financial ecosystem. Using their parent’s app or debit/credit card is not without its risks. In recent instances, a teen inadvertently made a transaction of Rs. 6,000 on their parent’s app while in another instance, a teenager having access to his parent’s bank accounts used it to upgrade his online game account making a spend of Rs. 16 lacs. The teenager reportedly made in-app purchases for his teammates as well, which the parent realised only after the transaction was completed.

FamPay recently launched India’s first numberless card, exclusively for teenagers, who can now use their own card to independently shop online/offline along with getting their own UPI ID. Parents can load the card using the FamPay app, and can monitor spends. The numberless card offers exceptional security, as the card details are safely stored in the device lock protected app and thus the card cannot be misused if lost/stolen.

India’s teens spend money on food, clothes and gadgets in that order. While spends on food is the highest among both boys and girls, 64 percent of boys spend more on gadgets as compared to 21 percent of girls. Teen girls, 66 percent of them prefer to spend more on clothes compared to 49 percent of boys. Teens have strong preferences when it comes to brands. Apple, Nike, H&M and Netflix emerged as the most popular brands among this cohort in their respective categories.

The survey reveals that teens get money on demand from their parents. Nearly 50% percent of all teens confirmed that they get money when they ask for it. Only 23 percent receive pocket money and 25 percent said that they typically receive money on their birthdays or from visiting relatives during festivals. Surprisingly, only 4 percent teens receive money for chores.

When it comes to their social media behaviour, Instagram is the most popular channel with nearly 80 percent of teens spending time on it, followed by YouTube and WhatsApp. Watching content is what 66 percent of teens do most on social platforms, followed by consuming news, and being in touch with friends, in that order.

Today’s teenagers are socially aware and not shy of voicing their opinion. The survey confirms that they are vocal about issues. A majority 55 percent are passionate about “Made in India”, 40 percent support the women empowerment agenda, 28 percent support Black Lives Matter and 19 percent support the LGBTQ cause.

Teens cite mutual respect and trust as being important aspects of their relationship with parents. Nearly 36 percent say that they would like their decisions to be respected more while 34 percent said that they would like their parents to not stress so much over their studies. Interestingly, more teen girls would like their parents to trust their decisions, while not stressing about their studies was highlighted more by teen boys. 20 percent of teenagers said that they would like their parents to spend more time with them.

The lockdown has disrupted routines for teens, just like everyone else. 20 percent teens miss eating out, 11 percent said they missed going to school, while an overwhelming 50 percent cite missing their friends the most during this time.

"From our interaction with teens, we know that parents don’t talk about money as much as they do about education with them. The teenage years are foundation building years, where one can acquire money skills and even afford to make mistakes while learning since the stakes are lower. It is crucial to form good habits during these years from financial skills to decision making. In fact with FamPay, thousands of teens have already started saving money.”, said Kush Taneja, Co-Founder, FamPay. “The recently announced National Strategy for Financial Education (NSFE) by RBI for the next five years (2020-2025) to disseminate financial education in the country is a welcome step in the same direction.”, he added.

Survey methodology

FamPay conducted this survey in August 2020 with 1200 teenagers in the age group of 10-19 years, across India with a majority of respondents being Delhi-NCR, Mumbai, Bengaluru, Chennai, Pune, Hyderabad, Pune and Kolkata. Of these, 68% were male and 32% were female.

Published by CNBC TV18, YourStory and Economic Times